How to Use Risk-Reward Ratios Effectively in Trading or Investing

Introduction

In the world of trading and investing, making money is not just about choosing the right stock or asset. It’s also about how you manage your risk. One of the simplest and most powerful tools to help with this is the Risk-Reward Ratio. Whether you’re trading stocks, forex, or cryptocurrencies, or investing for the long term, understanding how to use the risk-reward ratio can dramatically improve your decision-making and your returns. This blog will explain what the risk-reward ratio is, why it matters, and how you can apply it effectively in your trading or investment strategy.

What Is the Risk-Reward Ratio?

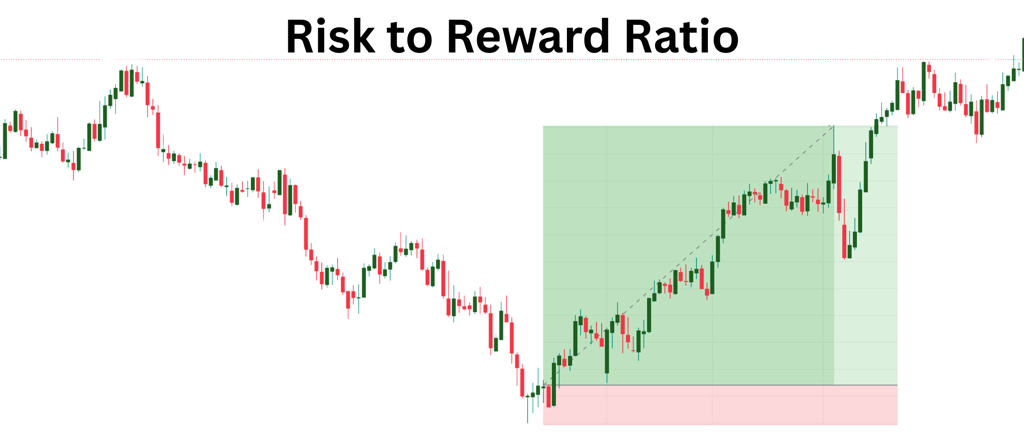

The risk-reward ratio compares the potential loss of a trade to the potential gain. It answers the simple question: “Is this trade worth the risk?” For example, if you’re risking $100 to potentially gain $300, your risk-reward ratio is 1:3. You are risking 1 unit to gain 3 units. This concept helps traders and investors decide whether a trade or investment has a favorable setup before they commit money to it.

Why the Risk-Reward Ratio Matters

One of the main reasons people lose money in markets is poor risk management. The risk-reward ratio gives you a structured way to look at each trade logically instead of emotionally.

Here’s why it’s so important:

Improves Decision-Making

It helps you assess trades based on expected outcomes rather than gut feeling or emotion.

Controls Losses

By focusing on setups with higher potential reward than risk, you naturally protect your capital.

Increases Profitability Over Time

Even if you’re not right most of the time, favorable risk-reward setups can make you consistently profitable.

How to Calculate Risk-Reward Ratio

Calculating risk-reward is simple.

Step 1: Define your entry price

Step 2: Set a stop-loss (maximum loss you can accept)

Step 3: Set a take-profit (your profit target)

Now use this formula:

Risk = Entry Price - Stop-Loss

Reward = Take-Profit - Entry Price

Risk-Reward Ratio = Risk ÷ Reward

Example:

Entry at $100

Stop-loss at $95 (risk is $5)

Target at $115 (reward is $15)

Risk-reward ratio = 5 ÷ 15 = 1:3

This means you are risking $1 to potentially make $3.

What Is a Good Risk-Reward Ratio?

There’s no single perfect number, but most traders aim for a minimum of 1:2 or 1:3.

This means:

For every $1 you risk, you should expect to earn at least $2 or $3.

Even if you win only 40% of your trades, you can still be profitable with a 1:3 ratio.

Some experienced traders may accept lower ratios if the win rate is extremely high, but for most, it’s better to aim for high reward setups to protect against losses.

Using Risk-Reward in Trading

1. Identify High-Probability Setups

Not every trade is worth taking. Look for setups where technical indicators, chart patterns, or fundamental signals suggest a strong move in your favor. A good setup should have a clear stop-loss and realistic profit target.

2. Stick to the Ratio

Once you find a setup, don’t change your stop-loss or take-profit levels emotionally. Traders often get tempted to hold losing trades longer or take profits too early. Both actions ruin your risk-reward planning.

3. Use Stop-Loss Orders

Always use stop-losses. The whole concept of the risk-reward ratio depends on limiting your losses. A stop-loss keeps your maximum risk predefined.

4. Avoid Chasing Low-Ratio Trades

Many beginners jump into trades that have a risk-reward of 1:1 or worse. While they may look like “safe” bets, these trades offer little upside and can drain your capital if your win rate is not very high.

Using Risk-Reward in Investing

For long-term investors, risk-reward is about valuing upside potential versus downside risk over time.

1. Fundamental Analysis

Look at earnings, valuations, growth potential, and industry trends. If a stock is trading at a low price compared to its intrinsic value and has strong growth ahead, the reward may far outweigh the risk.

2. Portfolio Allocation

Diversify your investments across different assets. Allocate more capital to investments with higher risk-reward ratios and manage your position size according to the potential downside.

3. Margin of Safety

Legendary investors like Warren Buffett focus on having a margin of safety. This means buying assets when they are undervalued, so the risk is minimized and the reward is amplified.

Psychological Benefits of Using Risk-Reward

Apart from helping you manage trades logically, the risk-reward ratio can also improve your discipline and confidence.

It removes guesswork from your trading process

You are less likely to panic during market volatility

You make more rational decisions instead of reacting emotionally

This approach keeps your expectations realistic and focused on the long-term outcome, not just short-term wins or losses.

Common Mistakes to Avoid

1. Ignoring the Risk

Many traders focus only on how much they can make, not how much they could lose. Always look at both sides before entering a trade.

2. Moving Stop-Losses

Changing your stop-loss once the trade is live often leads to bigger losses. Stick to your original plan.

3. Chasing Trades with Poor Ratios

If you consistently take trades with bad risk-reward setups, even a high win rate won’t help you in the long run.

4. Overtrading

If you can’t find a trade with a solid risk-reward ratio, it’s better to stay out. Patience pays off.

Combining Risk-Reward with Win Rate

Risk-reward ratio works best when combined with your win rate (percentage of successful trades).

For example:

If your risk-reward ratio is 1:3 and your win rate is just 40%, you can still make money.

If your ratio is 1:1, you’d need to win over 50% of your trades to be profitable.

This balance helps you build a system that works consistently over time.

Final Thoughts

The risk-reward ratio is a simple yet powerful concept that every trader and investor should understand and apply. It helps you make smarter decisions, control your losses, and increase your chances of long-term success. Don’t treat each trade as a gamble. Instead, approach it like a professional business decision where the potential return must justify the risk involved. With discipline, planning, and patience, mastering the risk-reward ratio can turn an average trading approach into a consistently profitable one.